The SBA HUBZone Office put out some new rules regarding shared office spaces. While these rules may seem stricter, it is actually good that they have put the policy in writing so that it is clear on what will qualify for your principal office and what will not. For companies looking to lease a new space or apply to the HUBZone program, please follow the guidelines below and share this with your landlord so that your lease can include all required information. This new policy should be posted to the SBA’s website soon.

Who counts as a Hubzone resident and how do you prove it?

By now you probably know that at least 35% of your total employees must reside in a HUBZone. By total employees, we mean every single employee that works more than 40 hours a month, no matter where they work. This means employees that work at your principal office, other office locations, jobsites, and remotely from home, all count towards that 35% that you must meet.

Five Eligibility Requirements to get SBA Hubzone Certified

If you would like a Hubzone Program eligibility analysis, please take our online hubzone eligibility questionnaire.

You are also welcome to review the basic eligibility requirements below. Generally, to be approved into the Hubzone Program you must meet these basic eligibility requirements:

Eligibility Criteria 1:

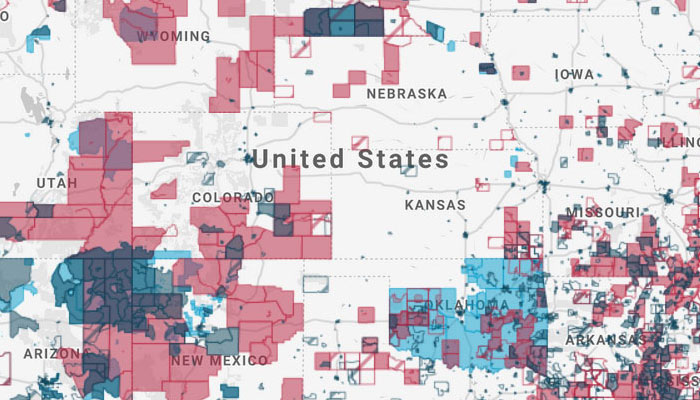

Your business concern’s principal office must be located in a qualified SBA designated Hubzone. Search the SBA’s Mapping system and verify if your principal office is located in a qualified SBA designated Hubzone.

When to start your VetBiz Contracting Program Renewal

Eligibility in the VA’s VetBiz Program is valid for 3 years from the date of your verification approval letter. The VetBiz VIP system will send out emails starting at 150 days prior to your expiration. They will continue sending you reminders every 30 days until your renewal is submitted or your verification expires.

Can you get 8(a) Certified if you have a family member who is or has been 8(a) Certified?

One of the many questions we get is “Can I get 8(a) Certified if I have a family member who is currently or previously 8(a) Certified?”

See below for the answer to this question.

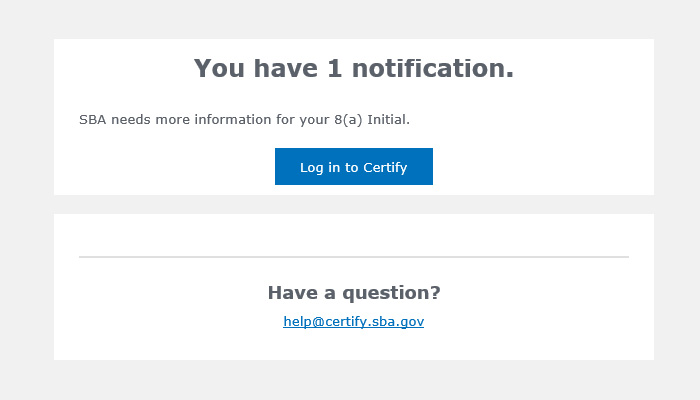

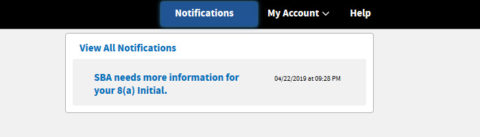

SBA Certify.SBA.GOV 8(a) Application Notification Help

So you submitted your 8(a) Application through certify.sba.gov and now you received a “Notification“, what do you do next?

Step 1: Login to certify.sba.gov.

Step 2: Go to the top of the page and click on “Notifications“. See below.

The real benefits of getting SBA 8(a) Certified

1. You will have access to sole source/non-competitive federal contracts with a value of:

- $4M and under for all services related contracts.

- $6.5M and under for manufacturing related contracts.

2. You will have access to competitive set-aside federal contracts with a value of:

- $4M and over for all services related contracts.

- $6.5M and over for manufacturing related contracts.

Top 10 8(a) Program Continued Eligibility Problems

1) Late or non-submission of 8(a) Annual Review documents.

The most common eligibility problem 8(a) firms encounter is either the late or non-submission of required 8(a) Annual Review documents. The SBA is required to review each 8(a) firm’s program eligibility every year on the firm’s certification anniversary date. Your local SBA office will send a request for the required Annual Review documents and information shortly before the end of your program year which contains the date that your submission is due back to your SBA Business Development Specialist (BDS). If it is not received by the due date, you will be sent a reminder and a second due date. If the information is not submitted by this second date, SBA’s rules & regulations require the SBA to start program termination proceedings against your firm. The termination process may result in the loss of your 8(a) certification. Once it is lost you cannot be certified in the 8(a) program again. Since annual reviews are done every year on your anniversary date, you should be prepared for it and comply on time.

3 Tips for VetBiz Verification

Below are 3 VetBiz Certification issues that we see on a regular basis. If you can avoid these three issues, your VA VetBiz application will go through the verification process much faster and with a positive outcome.

1. Full-time Devotion to the Applicant Concern

The 51% Veteran or Service-Disabled Veteran owner(s) should devote full time to the applicant concern during normal operating hours of similar businesses. In addition, the veteran owners should not have any other outside employment that could take away from their day-to-day management of the applicant firm. Make sure resumes and LinkedIn profiles are up to date with current positions and previous employment has ended. Any Veterans with outside employment will face many questions from the CVE which will most likely end in denial.

How to determine your Adjusted Net Worth

The applicant(s) for 8(a) Certification must have an Adjusted Net Worth of less than $850,000 and total assets of less than $6,500,000 to be considered economically disadvantaged by the SBA.

What is the definition of Adjusted Net Worth?

Adjusted Net Worth = Personal Assets – Liabilities – [Equity in primary residence + ownership interest in business + IRA/Other Retirement].

Additionally, Total Assets = Personal Assets – IRA/Other Retirement.